Double Declining Balance Method: Formula & Free Template

You cannot use MACRS for personal property (section 1245 property) in any of the following situations. For a discussion of when property is placed in service, see When Does Depreciation Begin and End, earlier. For a description of related persons, see Related Persons, later.

Example 3: Double-Declining Depreciation in Last Period

Figure your depreciation deduction for the year you place the property in service by multiplying the depreciation for a full year by a fraction. The numerator of the fraction is the number of full months in the year that the property is in service plus ½ (or 0.5). During the year, you bought a machine (7-year property) for $4,000, office furniture (7-year property) for $1,000, and a computer (5-year property) for $5,000. You placed the machine in service in January, the furniture in September, and the computer in October. You do not elect a section 179 deduction and none of these items is qualified property for purposes of claiming a special depreciation allowance.

Get in Touch With a Financial Advisor

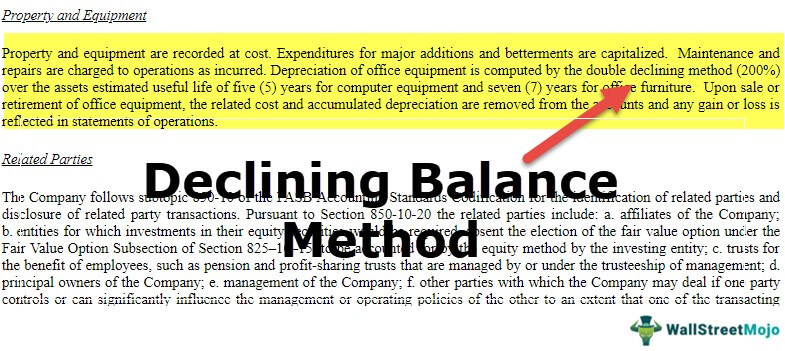

Proponents of this method argue that fixed assets have optimum functionality when they are brand new and a higher depreciation charge makes sense to match the fixed assets’ efficiency. This section describes the maximum depreciation deduction amounts for 2023 and explains how to deduct, after the recovery period, the unrecovered basis of your property that results from applying the passenger automobile limits. An improvement made to listed property that must be capitalized is treated as a new item of depreciable property. The recovery period and method of depreciation that apply to the listed property as a whole also apply to the improvement. For example, if you must depreciate the listed property using the straight line method, you must also depreciate the improvement using the straight line method. Special rules apply to figuring depreciation for property in a GAA for which the use changes during the tax year.

Need Business Insurance?

This means you bear the burden of exhaustion of the capital investment in the property. Therefore, if you lease property from someone to use in your trade or business or for the production of income, generally you cannot depreciate its cost because you do not retain the incidents of ownership. You can, however, depreciate any capital improvements you make to the property.

- Your total cost is $140,000, the cash you paid plus the mortgage you assumed.

- If, in the first year, you use the property for less than a full year, you must prorate your depreciation deduction for the number of months in use.

- No actual cash is put aside, the accumulated depreciation account simply reflects that funds will be needed in the future to replace the fixed assets which are reducing in value due to wear and tear.

- You generally deduct the cost of repairing business property in the same way as any other business expense.

- However, one can see that the amount of expense to charge is a function of the assumptions made about both the asset’s lifetime and what it might be worth at the end of that lifetime.

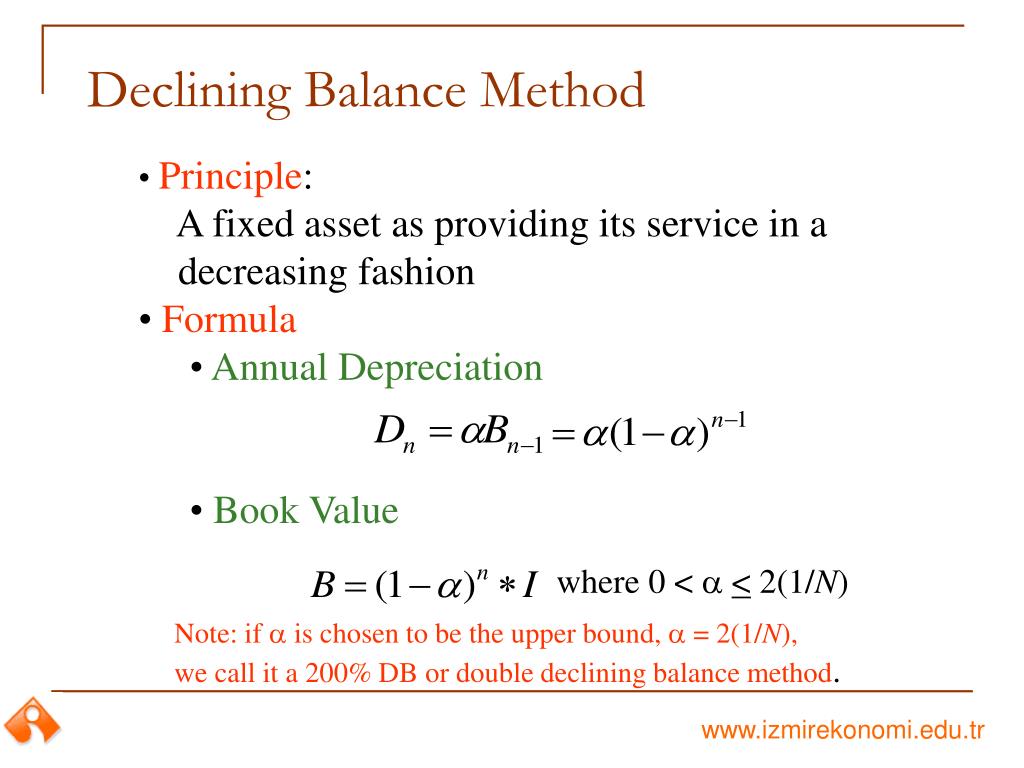

However, Dean’s deduction is limited to the business taxable income of $80,000 ($50,000 from Beech Partnership, plus $35,000 from Cedar Partnership, minus $5,000 loss from Dean’s sole proprietorship). Dean carries over $45,000 ($125,000 − $80,000) of the elected section 179 costs to 2024. Dean allocates the carryover amount to the cost of section 179 property placed in service in Dean’s sole proprietorship, and notes that allocation in the books and records. The double declining balance method accelerates depreciation charges instead of allocating it evenly throughout the asset’s useful life.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our completed contract method meaning examples financial content. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Land and land improvements do not qualify as section 179 property. Land improvements include swimming pools, paved parking areas, wharves, docks, bridges, and fences. If you file a Form 3115 and change from one permissible method to another permissible method, the section 481(a) adjustment is zero. If an amended return is allowed, you must file it by the later of the following. The nontaxable transfers covered by this rule include the following.

You did not elect a section 179 deduction and elected not to claim any special depreciation allowance for the 5-year property. You used the car exclusively for business during the recovery period (2017 through 2022). The passenger automobile limits generally do not apply to passenger automobiles leased or held for leasing by anyone regularly engaged in the business of leasing passenger automobiles.

It is something like a subclass of declining balance depreciation. In the above example, we assumed a depreciation rate equal to twice the straight-line rate. However, many firms use a rate equal to 1.5 times the straight-line rate.

Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate. When the depreciation rate for the declining balance method is set as a multiple, doubling the straight-line rate, the declining balance method is effectively the double-declining balance method. Over the depreciation process, the double depreciation rate remains constant and is applied to the reducing book value each depreciation period.

The numerator of the fraction is the number of months (including parts of months) the property is treated as in service in the tax year (applying the applicable convention). If there is more than one recovery year in the tax year, you add together the depreciation for each recovery year. You determine the straight line depreciation rate for any tax year by dividing the number 1 by the years remaining in the recovery period at the beginning of that year. When figuring the number of years remaining, you must take into account the convention used in the year you placed the property in service. If the number of years remaining is less than 1, the depreciation rate for that tax year is 1.0 (100%).